August 20, 2021

Produced in partnership with Groom Law Group, Chartered

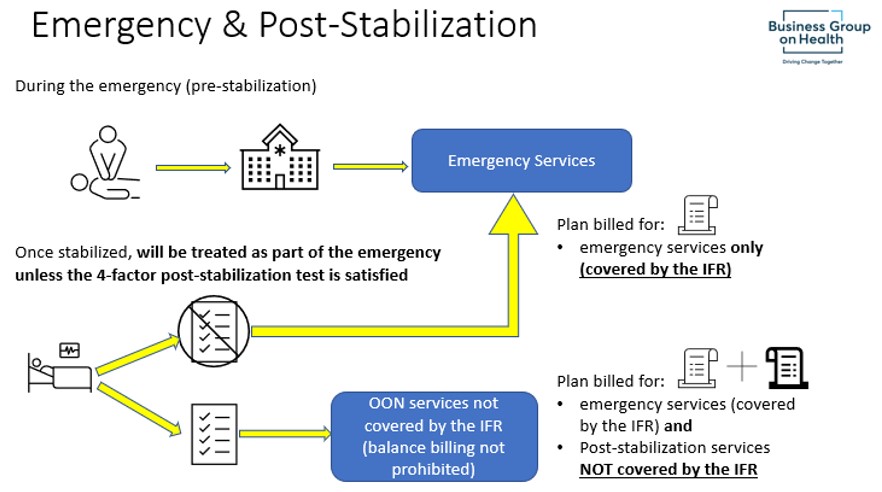

On July 1, 2021, Treasury, HHS, and the DOL jointly released the interim final rule “Requirements Related to Surprise Billing; Part I” (“the IFR”). These rules are the first in a series of rules implementing the Consolidated Appropriations Act of 2021’s (“CAA”) surprise billing and transparency requirements. The IFR generally applies to group health plans and health insurance issuers for plan (or policy) years beginning on or after January 1, 2022. The rules apply to health care providers and facilities, as well as providers of air ambulance services, also beginning on January 1, 2022.

The Business Group has developed an illustrated summary of the main provisions to help employer plan sponsors follow these new requirements.

More Topics

Articles & Guides

This content is for members only. Already a member?

Login

![]()